Montana Endowment Tax Credit

A powerful way to give back to Montana and reduce your taxes

What is the Montana Endowment Tax Credit (METC)?

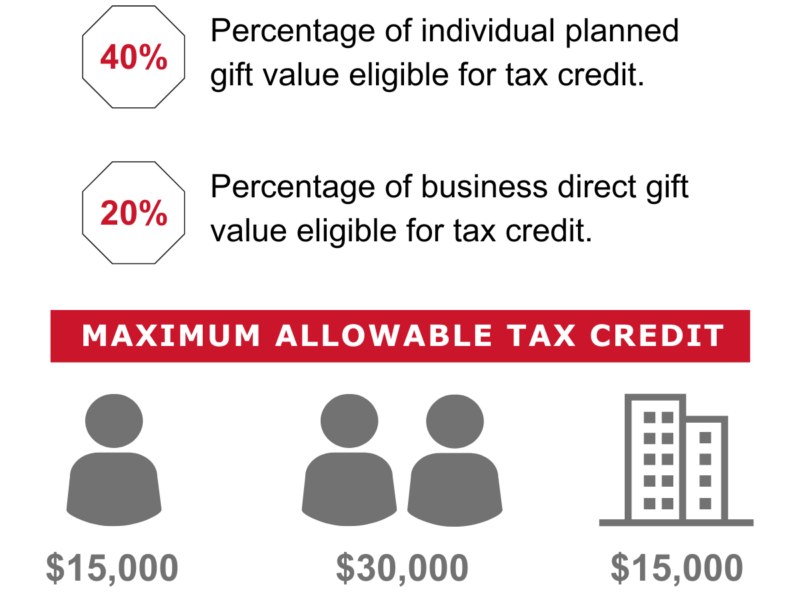

The Montana Endowment Tax Credit (METC) is a unique opportunity for individuals, businesses, and organizations to support Montana communities while receiving a tax credit. Established in 1997, this credit allows a 40% tax credit on a qualifying planned gift's federal charitable deduction (up to $15,000 annually per individual, or $30,000 for couples) or a 20% tax credit for direct gifts by qualified businesses (up to $15,000 annually).

Why Choose a Planned Gift?

Planned gifts, such as charitable trusts, gift annuities, and certain estate gifts, provide donors with income and tax planning tools while supporting Montana’s charities and community foundations. These gifts help sustain Montana’s nonprofits, ensuring ongoing support for community-focused programs.

Deferred Gift Annuity Example: 61-year-old

- $10,000 Cash Gift

- $3,794 METC

- $5,690 Federal Charitable Tax Deduction

- Annuity payments are deferred until later, then the Donor receives $500/year for life.

- After 5 years, the Donor can relinquish future payment rights for a small additional Federal Tax deduction.

- Upon relinquishment or Donor's death, the remainder goes to the chosen endowment fund(s).

Ready to Get Started?